WIN® – Women Investors Network

As a women-led advisory team, we understand the unique financial dynamics women face—both personally and professionally. That’s why we created WIN® — the Women Investors Network, a specialized wealth management approach designed by women, for women.

WIN® – Women Investors Network

While the fundamentals of personal finance apply to all, women face unique financial realities—such as longer life expectancy, potential career breaks, or wage gaps. These factors make it even more essential for women to be proactive, confident, and empowered in their financial journeys.

Facts & Figures

Gender Gap

As of 2025, the global gender gap has been closed by 68.8% across the 148 economies included in this year's index. At the current pace of progress, it is estimated that it will take 123 years to achieve full gender parity worldwide.

Pay Disparity

Women typically earn less over their careers, contributing to persistent wealth and retirement gaps. The gender pay gap in the financial sector in India is around 18%. The gap is wider in certain fields.

Longevity

Globally, women outlive men by five to eight years, making long-term financial planning even more essential to ensure financial security in later life. Yet, many women underestimate how much they’ll need to sustain their lifestyle through those extra years.

Handling Finances

In many households, women aren't involved in financial decisions—leaving them vulnerable during life transitions such as widowhood, divorce, or inheritance. Data suggests that 90% women will have sole responsibility for their finances at some point in their lives.

What WIN® Offers:

• Tailored investment strategies aligned with your personal goals and life stages.

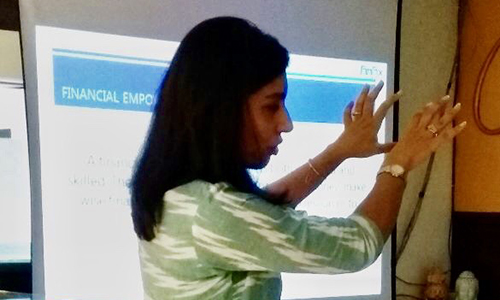

• Education-based workshops and sessions to boost financial literacy and decision-making confidence.

• A strong community of women supporting and empowering one another through shared financial journeys.

At WIN®, our mission is to help women unlock the full potential of their wealth—not only by managing money, but by making smart, empowered decisions for today, tomorrow, and the future.

Women & Finance Workshops

Involve Yourself

Our workshops for women are aimed at engaging with women from different walks of life to encourage and equip them with skills related to personal finance