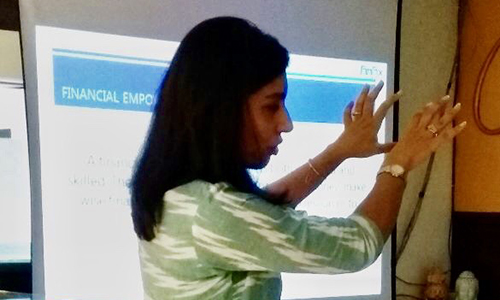

We are passionate about educating women and making them proactive in matters related to personal finance. Our financial workshops are structured to engage women in their financial journeys.

WIN® – Women Investors Network

Facts & Figures

-

Leadership

Women currently hold 32 (6.4%) CEO positions at S&P 500 companies as of July 2022, based on the January 2022 S&P 500 list. [1]

-

Gender Gap

In 2022, the global gender gap has been closed by 68.1%. At the current rate of progress, it will take 132 years to reach full parity. [2]

-

Pay Disparity

The gender pay gap in the financial sector in India is around 18%. [3] The gap is wider in certain fields.

-

Longevity

Across the world, women outlive men—on average by five to eight years. [4]

-

Handling Finances

90% women will have sole responsibility for their finances at some point in their lives. [5]

-

Unpaid Work

On average across the globe, women spend 4 hours and 22 minutes per day in unpaid labor, compared to only 2 hours and 15 minutes for men. [6]

Women & Finance Workshops

Involve Yourself

Our workshops for women are aimed at engaging with women from different walks of life to encourage and equip them with skills related to personal finance